When scouting for investments, the extensive list of options out there can sometimes make the task challenging and overwhelming.

However, targeting companies carrying little to no debt can be a great initial filter when searching, as these companies can use their excess cash to fuel other areas of business, including growth opportunities.

Three companies that fit the criteria – Monster Beverage Corp. (MNST – Free Report) , SEI Investments (SEIC – Free Report) , and Paychex (PAYX – Free Report) – could all be considered.

Below is a chart illustrating the performance of all three stocks over the last year, with the S&P 500 blended in as a benchmark.

Image Source: Zacks Investment Research

Let’s take a closer look at each one.

Monster Beverage Corp.

Monster Beverage is a marketer and distributor of energy drinks and other alternative beverages. Currently, the company sports a Zacks Rank #2 (Buy).

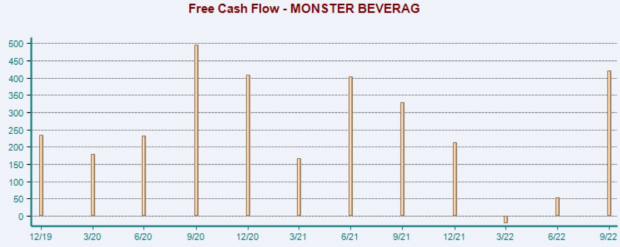

In its latest quarter, MNST generated $422 million in free cash flow, good enough for a solid 28% Y/Y increase. As we can see in the chart below, the company’s free cash flow has recovered from 2022 lows.

Image Source: Zacks Investment Research

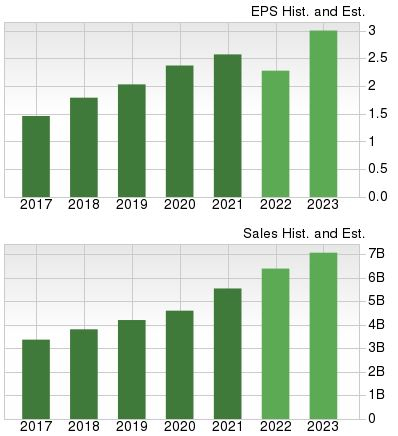

Monster’s earnings are forecasted to take a hit in its current fiscal year (FY22), with estimates indicating an 11% Y/Y decrease. Still, growth resumes in FY23, with estimates calling for 30% Y/Y earnings growth.

Image Source: Zacks Investment Research

SEI Investments

SEI Investments is a leading global provider of asset management, investment processing, and investment operations solutions. SEIC is a Zacks Rank #3 (Hold).

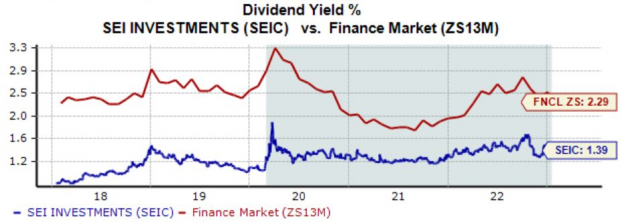

For those with an appetite for income, SEIC has that covered; the company’s annual dividend currently yields 1.4%.

While the current yield is below its Zacks Finance sector average, SEIC’s 7% five-year annualized dividend growth rate picks up the slack in a big way.

Image Source: Zacks Investment Research

The company snapped a streak of mixed earnings results in its latest release, exceeding the Zacks Consensus EPS Estimate by more than 11% and penciling in a 2.6% sales surprise.

Image Source: Zacks Investment Research

Paychex Inc.

Paychex is a recognized leader in the payroll, human resource, and benefits outsourcing industry. PAYX’s earnings outlook has drifted higher over the last several months, pushing it into a Zacks Rank #2 (Buy).

Image Source: Zacks Investment Research

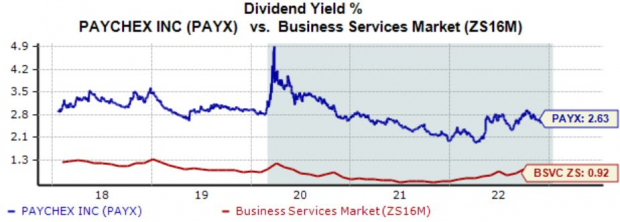

Like SEIC, Paychex rewards its shareholders; its annual dividend currently yields a solid 2.6%, well above its Zacks Business Services sector average of 0.9%.

Impressively, the company’s payout has grown by nearly 8% over the last five years.

Image Source: Zacks Investment Research

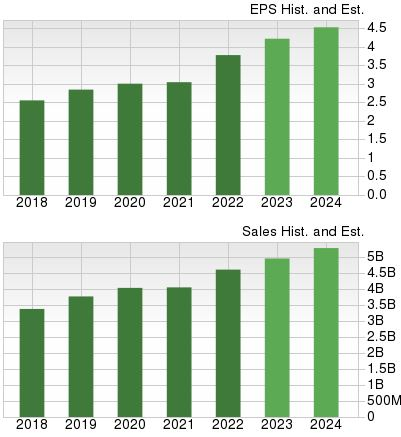

And to top it off, PAYX carries a favorable growth profile, with earnings forecasted to climb 13% in FY23 and a further 8% in FY24.

The projected earnings growth comes on top of estimated Y/Y revenue upticks of 8.2% and 6% in FY23 and FY24, respectively.

Image Source: Zacks Investment Research

Bottom Line

For those with a more conservative approach, targeting companies with little to no debt is an excellent initial screen when searching for potential investments.

After all, nobody wants to see a company they own become bogged down with obligations, negatively impacting other business areas.

And all three stocks above – Monster Beverage Corp. (MNST – Free Report) , SEI Investments (SEIC – Free Report) , and Paychex (PAYX – Free Report) – fit the criteria, carrying little to no debt.