The truth is that if you invest for long enough, you’re going to end up with some losing stocks. But long term Spectral Medical Inc. (TSE:EDT) shareholders have had a particularly rough ride in the last three year. Unfortunately, they have held through a 57% decline in the share price in that time. The falls have accelerated recently, with the share price down 18% in the last three months.

Since Spectral Medical has shed CA$17m from its value in the past 7 days, let’s see if the longer term decline has been driven by the business’ economics.

View our latest analysis for Spectral Medical

We don’t think Spectral Medical’s revenue of CA$1,661,000 is enough to establish significant demand. This state of affairs suggests that venture capitalists won’t provide funds on attractive terms. So it seems shareholders are too busy dreaming about the progress to come than dwelling on the current (lack of) revenue. For example, they may be hoping that Spectral Medical comes up with a great new product, before it runs out of money.

Companies that lack both meaningful revenue and profits are usually considered high risk. You should be aware that the company needed to issue more shares recently so that it could raise enough money to continue pursuing its business plan. While some such companies do very well over the long term, others become hyped up by promoters before eventually falling back down to earth, and going bankrupt (or being recapitalized). Spectral Medical has already given some investors a taste of the bitter losses that high risk investing can cause.

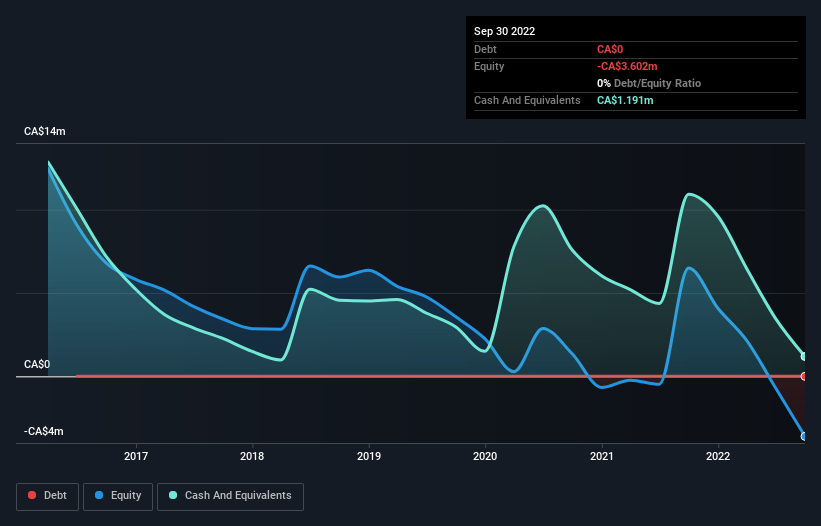

Spectral Medical had liabilities exceeding cash when it last reported, according to our data. That put it in the highest risk category, according to our analysis. But with the share price diving 16% per year, over 3 years , it’s probably fair to say that some shareholders no longer believe the company will succeed or they are worried about dilution with the recent cash injection. You can click on the image below to see (in greater detail) how Spectral Medical’s cash levels have changed over time.

In reality it’s hard to have much certainty when valuing a business that has neither revenue or profit. Would it bother you if insiders were selling the stock? I would feel more nervous about the company if that were so. It costs nothing but a moment of your time to see if we are picking up on any insider selling.

A Different Perspective

It’s good to see that Spectral Medical has rewarded shareholders with a total shareholder return of 19% in the last twelve months. Notably the five-year annualised TSR loss of 3% per year compares very unfavourably with the recent share price performance. This makes us a little wary, but the business might have turned around its fortunes. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We’ve spotted 4 warning signs for Spectral Medical you should be aware of, and 1 of them is significant.

Spectral Medical is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

Valuation is complex, but we’re helping make it simple.

Find out whether Spectral Medical is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Source link