SDI Productions/E+ via Getty Images

Overview

Cano Health, Inc. (NYSE:CANO) has 46% upside. In my opinion, CANO stock has been heavily sold off to an extreme level that is unjustified. I believe that CANO offers a compelling value proposition to its stakeholders, and it has certainly demonstrated strong organic member growth. Based on the current valuation and the positive FY23 outlook, I believe Cano Health, Inc. is worth investing in.

Business description

CANO is one of the largest independent primary care physician [PCP] groups in Florida. The group’s physicians provide care for their patients via a value-based, digitally-enabled healthcare platform.

U.S. healthcare faces plenty of challenges

There are a lot of issues plaguing the U.S. healthcare system right now. The United States spends more money than any other country on healthcare per person, but its citizens’ health is no better as a result. At a high level, the way healthcare works in the United States has poor primary care access, insufficient patient care coordination, inadequate data utilization to drive decision making, and physicians who are financially incentivized to prioritize quantity over quality. In comparison to other developed countries, the United States also underinvests in primary healthcare. The use of preventive health services is only about 55% of the recommended rate, leading to poor health outcomes. The current healthcare system is also met with widespread discontent.

In my opinion, primary care is best suited to meet these challenges in the healthcare system. Primary care has a large impact on the annual healthcare spending in U.S. because of its position at the top of the funnel. As a point of reference, CANO S-1 reports that the typical PCP brings in only $500,000 annually in direct healthcare revenue, but affects $10 million annually in spending across the healthcare system as a whole.

However, most PCP groups are not ready to deliver improved health outcomes, despite this chance to enhance the health system. Most primary care physicians work alone or in small groups and lack the resources and organizational structure necessary to effectively manage risk and enhance care coordination.

Value-based primary care is gaining in popularity

In my view, doctors aren’t properly incentivized by the standard fee-for-service [FFS] system. Instead, doctors are compensated solely in terms of the number of services they provide, which puts quantity ahead of quality. Poor long-term health outcomes and the accompanying increases in healthcare costs for both payors and patients are a common result of this shift away from a focus on preventative care and care coordination.

Value-based care has gained popularity as a preferred payor model due to the fact that it brings the interests of patients, providers, and insurers into harmony. This eventually leads to patients receiving superior care and having more positive experiences overall. Moreover, in a value-based care model, providers can increase their profitability by enhancing the long-term health outcomes of members.

Thus, Medicare is shifting from its previous payment system to one based on the value of care provided. Medicare Advantage is the fastest growing segment of the senior healthcare market because of rising healthcare costs and an aging population. It is estimated that only 30% of the 28.4 million Medicare Advantage recipients are participating in value-based care at this time.

Although the Centers for Medicare & Medicaid Services [CMS] and Medicare Advantage plans prefer providers who deliver care based on value, only a small fraction of providers are prepared to meet this demand. CANO steps in to make an impact in these situations by specializing in capitated contracts.

CANO’s proprietary platform is its backbone and also a competitive advantage

CanoPanorama is a health management system built into the CANO value-based care delivery platform that provides analytics, reports, and protocols to back up critical care management plans. By utilizing CanoPanorama, CANO has established procedures to guarantee that medical professionals and members get the help they need.

In my opinion, this platform is a game-changer because it equips doctors at CANO clinics with a panoramic view of their patients, as well as insights that allow them to make more informed care decisions. Through the use of CanoPanorama, CANO is able to categorize newly enrolled members into risk categories, empowering primary care physicians to create and implement care plans for each individual that are more effective. CanoPanorama members receive proactive and dynamic care based on their changing health status because of the continuous collection of data on them from a variety of sources after enrollment. As a result of this data advantage, CANO is better able to categorize its members by risk and provide individualized care plans to meet their specific medical requirements.

CANO has formed key relationships with preferred providers

CANO is an integral part of the provider networks for a variety of health plans due to the quality of the relationships it has cultivated with these organizations. When forming a provider partnership in the value-based care industry, health plans aim to increase membership, improve clinical quality, and reduce medical costs. All of which are within the capabilities of CANO. The successes of CANO are further bolstered when its collaborations with others are taken into account. CANO is widely recognized as an excellent choice by a wide range of Medicare and Medicaid health plans, including some of the largest providers in the business.

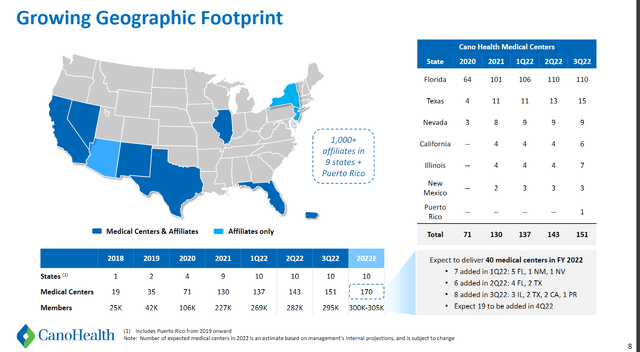

Geographic footprint

CANO’s global reach is another differentiating factor. CANO has shown that it can successfully expand into new markets, even as the majority of its locations remain in the developed value-based care market in Florida. I see this as crucial because it will determine how much room for expansion CANO has and how well the business can continue to make money.

Streak of misses, but could things turn for the better?

CANO’s 3Q22 earnings report was weak. CANO did not meet financial expectations for the second consecutive quarter. This was due to revenue rates for new patients not matching their acuity levels. As a result of this and the expected impact on the fourth quarter, management revised their financial guidance for the FY22 to more accurately reflect the challenges related to revenue rates and higher medical loss ratios [MLR] from new members.

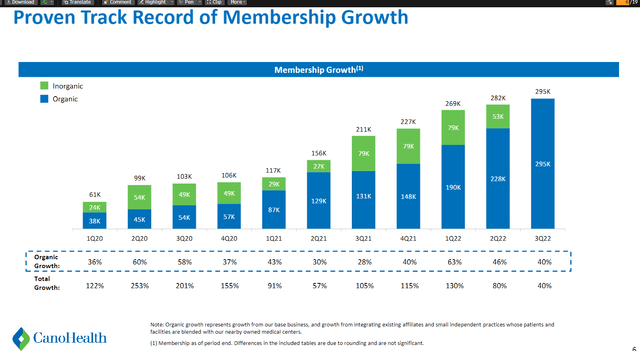

Despite the lower expectations for the fiscal FY22, I am encouraged by CANO’s strong growth in membership, which I expect to lead to increased revenue and earnings in FY23 when Medicare Advantage payments per member per month [PMPM] adjust upward. To conserve cash and improve free cash flow, management is expecting to open fewer new clinics in the coming year. However, with 170 planned clinics for the FY22 and plenty of remaining capacity, this should not have a significant impact on near-term growth, and the company still expects strong membership expansion in FY23.

Forecast

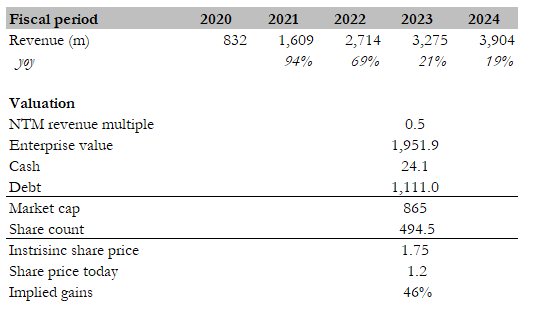

CANO’s share price has clearly been decimated since the company’s poor earnings in 3Q22 (the stock is down more than 90% since then). I agreed with the negative narrative at the time, but it appears to me that the stock has been beaten down to absurd levels. As previously stated, I believe that management’s strong organic growth and cash preservation strategy will benefit the stock in FY23.

According to consensus estimates, CANO’s revenue in FY24 will be around $3.9 billion. If we assume CANO trades at the same 0.5x revenue valuation (assuming no positive change), CANO is worth $1.75, or 46% more.

Author’s estimates

Key risks

Full-risk capitation model

CANO assumes the entire financial risk associated with covering the healthcare needs of its Medicare Advantage and dual-eligible members through a full-risk capitation model. Since CANO’s doctors are employees rather than owners, they have no financial stake in the outcomes of the patients they treat.

Expertise in Florida might not work in other regions

CANO established itself in the South Florida market, which has been receptive to capitation models for some time. The execution and model portability risk is higher when entering new markets that are not used to value-based or capitation models.

Conclusion

Overall, the buy case for Cano Health, Inc. is based on their leadership in value-based primary care, their proprietary platform, and the expected growth in the Medicare Advantage market.

The current healthcare system in the U.S. has a lot of issues, including poor primary care access and a lack of data-driven decision making, and primary care is well positioned to address these challenges. Medicare is shifting towards a value-based payment system and the Medicare Advantage market is expected to grow, so it’s a good time to be in value-based primary care.

Source link