PM Images

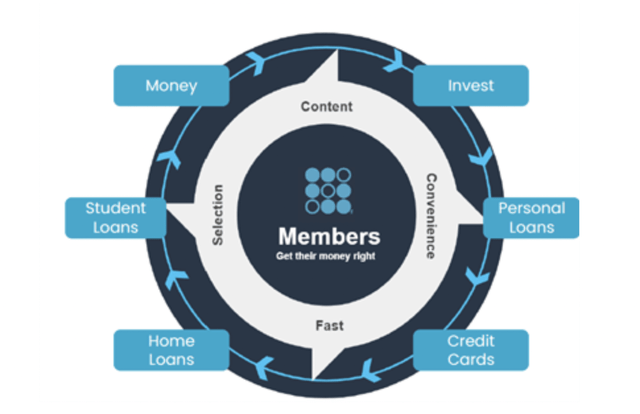

SoFi (NASDAQ:SOFI) is a leading fintech company which originally specialised in student loans before branching out to personal loans, credit cards, home loans and even investing. The company has recently announced super financial results for the fourth quarter of 2022, as it beat both top and bottom line growth estimates. SoFi is now on the road to profitability and has executed outstanding revenue and earnings growth, despite a negative backdrop regarding student loans and home mortgages. Its stock price popped by close to 13% on the positive earnings. In this post, I’m going to break down its financial report, before revealing my valuation model for the stock, let’s dive in.

Fourth Quarter Breakdown

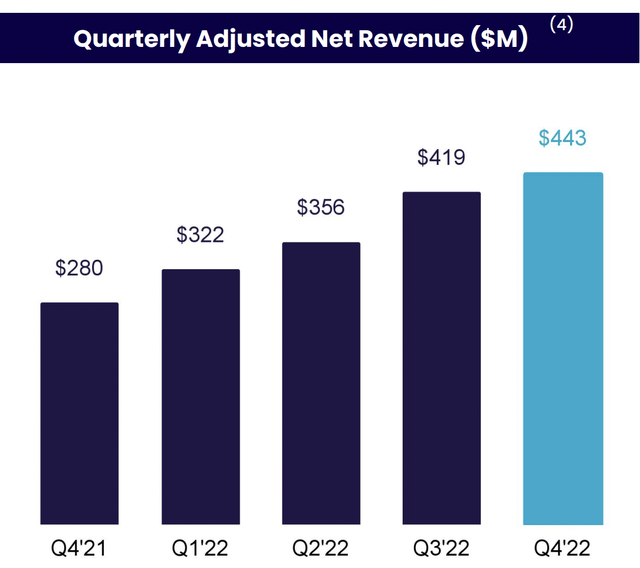

SoFi reported strong financial results for the fourth quarter of 2022. Revenue was $443.42 million which beat analyst expectations by $27.48 million and increased by a rapid 72.5% year over year. This was driven by record growth across all three of its segments; Lending, Technology Platform and Financial Services.

Breaking revenue down by segment, its largest segment business lending contributed to 74% of total revenue and generated revenue of $328.2 million [GAAP] in Q4,22 which increased by a rapid 54% year over year.

This was driven by strong growth in net interest income, which increased by a rapid 138% year over year, which was driven by the higher interest rate environment and a greater number of deposits. Its Non-interest income, was virtually “flat” year over year, this was driven by a variety of factors.

Total loan origination actually declined by 21% year over year. This was driven by the high interest environment ,which impacted home loan originations and caused a decline of an eye watering 84%.

Student loan volume declined by over 50% from the pre pandemic average, which was mainly due to loan “moratoriums”. In 2020, the Biden Administration announced a halt on student loan payments to help students deal with the crisis and better manage their finances. This was only expected to be a temporary measure but in November 2022, this was extended by another 6 months. Biden is also seeking the ability “cancel” $20,000 worth of student debt, for those who received Pell Grants in college. In addition, Biden aims to cancel $10,000 worth of debt, for all other borrowers who earn below $125,000. The plan is currently going through the courts and is expected to have ruling by June 30th 2023. As SoFi specialises in student loan refinancing and private student loans, the company is likely to be impacted by Biden’s plans even though it is positive for students overall.

The positive for SoFi is its Personal Loan originations were a standout performer with $2.5 billion in originations reported in Q4,22, up a rapid 50% year over year. For the full year of 2022, Personal Loan originations increased by a substantial 81%, to $9.8 billion. This has been driven by improved automation and accuracy of its underwriting model.

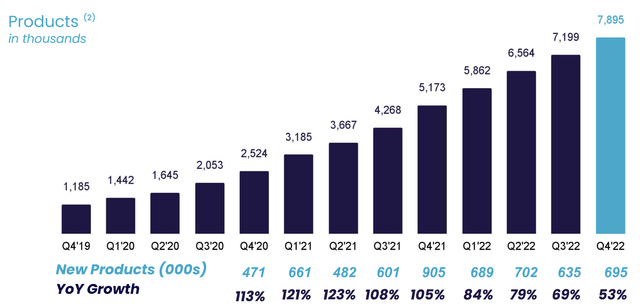

The company also reported a solid 53% year over year increase in its number of “products” to 7.9 million. Total “products” refers to the number of lending and financial services products that its members have selected on the platform. It’s great to see an increase in this figure as it means its customers are purchasing multiple “products” on the platform such as one home loan and one personal loan etc.

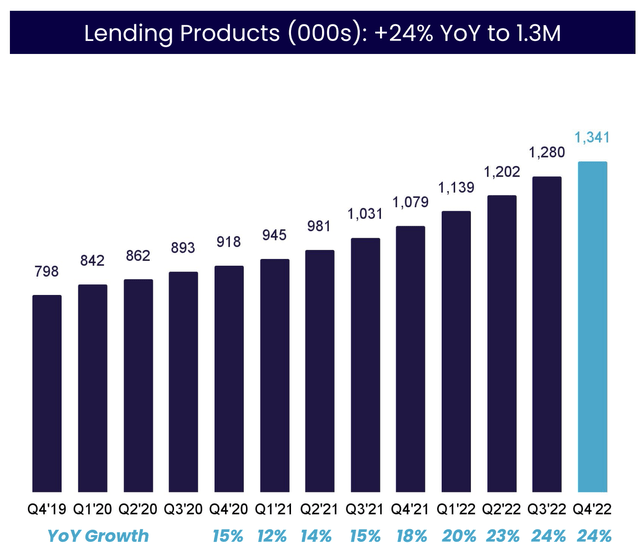

Its Lending Products specifically increased by a solid 24% year over year to 1.3 million. In the full year of 2022, its Lending net interest income was $530 million which surpassed its lending costs of $443 million for the first time. This was driven by increased growth in originations, products and larger deposits which lowered funding costs. As SoFi continues to grow and expand its business I expect these benefits to be amplified as the company benefits from increased operating leverage.

Lending Products (Q4,22 report)

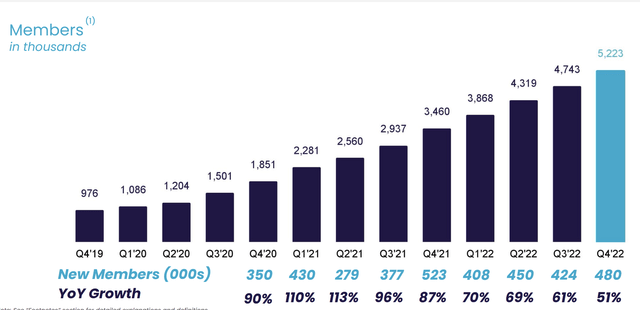

SoFi has also expanded its total number of members by a rapid 51% year over year to a substantial 5.2 million people.

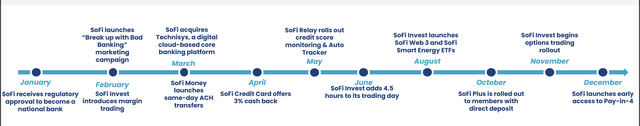

Overall revenue growth was a testament to the company’s diversified revenue model, which benefited from its “Financial Services Productivity Loop” [FSPL] strategy. SoFi has continued to innovate with its platform and scale out multiple offerings. The graphic below shows the timeline of SoFi’s offerings and notable events in 2022. For example, the company officially got its banking license in January 2022, which offers a range of benefits I will discuss later in this post. In addition, the company has made a number of acquisitions and launched a range of Smart energy ETF’s, and options trading features. The “invest” platform space has huge potential and SoFi plans to continually build out this product with multiple features. In addition, management believes it could offer an IPO underwriting service when the IPO market recovers from its cyclical declines. This could enable its members exclude IPO access at IPO prices. There are a couple of specialist brokers which offers this already but SoFi could open this up to the mainstream retail investor, which would be huge.

SoFi roadmap 2022 (Q4,22 report)

In December 2022, SoFi launched “Pay in 4”, which I see as a Buy Now Pay Later [BNPL] company. Buy Now Pay Later is a competitive industry with companies such as Affirm (AFRM), Klarna (in Europe) and Afterpay. The good news is the market still expanding and is forecast to grow at a rapid 33.3% compounded annual growth rate, reaching $90.51 billion by 2029. Given Block (formerly Square) acquired Afterpay in 2021, for a staggering $29 billion there looks to be plenty of perceived opportunity in the space. The expansion into different products and use cases further diversifies the business model of SoFi, while enabling greater cross selling opportunities.

Moving onto the financial services segment, its total “products” increased by 60% year over year to 6.6 million. This was driven by SoFi Money (Checking and Savings) accounts which increased by a rapid 53% year over year to 2.2 million. In addition, SoFi invest increased by 35% year over year to 2.2 million “products”. SoFi Relay which enables a unified view of all your various bank accounts via a dashboard also was extremely popular and increased by 107% year over year to 1.9 million products. The beautiful thing about financial products such as these is even during “recessionary”, they are popular as shown by the prior numbers. For example, SoFi Relay enables budgets to be set for the month which is useful for those trying to track costs in the current environment.

Its total deposits increased by a blistering 46% sequentially to a staggering $7.3 billion. These deposits benefit the company in a variety of ways from increases its net interest margin [NIM] and enabling a lower cost of funding for its loans.

Growing Brand Power and Network Effects

On the earnings call (which I’ve just listened to), management reported an increase in its “annualised revenue per product” by close to 2 times, from $21 in Q4,21 to $40 by Q4,22. This was mainly driven by growing brand awareness and increasing network effects. SoFi sponsors the “SoFi Stadium”, opened in 2020 in Inglewood, California. This stadium has been dubbed one of the most expensive ever built at $5.5 billion and includes state of the art technology. In addition, this was home to the Super Bowl in 2022, the most watched sporting event in the world. Therefore it is not a surprise to me that SoFi has grown its brand to become a household name which should pay dividends in the years to come. Legendary investor Warren Buffett is famous for investing into companies with “strong brands” such as Coca Cola and Gillette. He believes they have a “share of mind” with the consumer which can act as a competitive advantage long term. Although SoFi is still in the early stages of growing its brand it has made a positive start.

Technology Platform

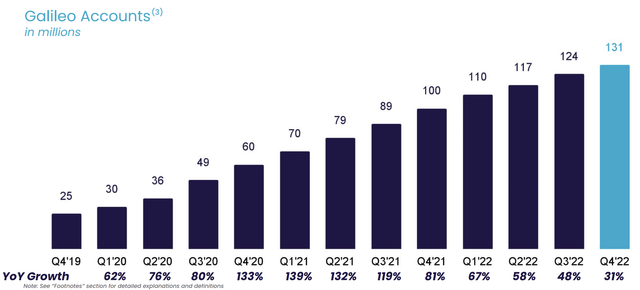

Sofi reported technology platform revenue of $85.7 million in Q4,22, which increased by a rapid 61% year over year. This was driven by solid growth in its Galileo accounts which increased by 31% year over year to 131 million. SoFi announced the acquisition of Galileo for $1.2 billion in 2020 and has made great progress so far. Galileo is a financial software company which offers an API (Application Programming Interface) ready platform which enables fintechs to setup various digital banking services easily.

SoFi also announced the acquisition of Technisys in 2022, which is a software company that provides the infrastructure behind various banking applications. This is part of SoFi’s mission to create the “AWS of Fintech” and believes ~$800 million in cost savings will be generated up until 2025. As SoFi uses the Technisys platform for its own product, the company has effectively become “vertically integrated”, which is aimed to help with the $85 million in cost savings expected.

Margins, Balance Sheet and Guidance

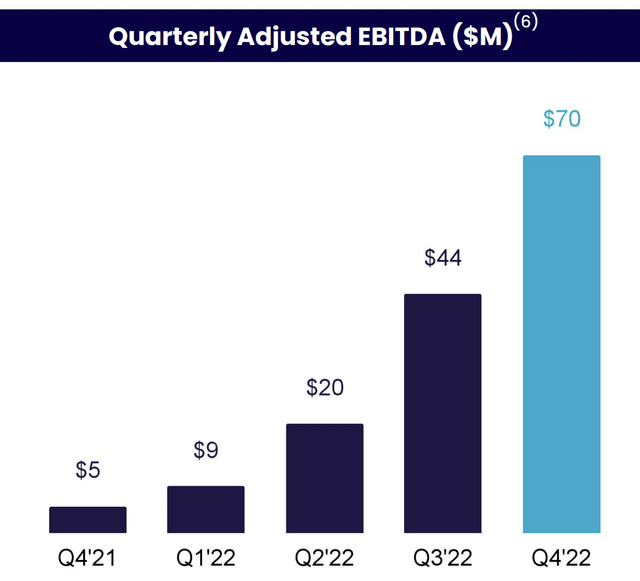

Moving on to margins, SoFi reported earnings per share [EPS] of negative $0.04, which beat analyst expectations of negative $0.08, according to Google finance data. The business reported a record adjusted EBITDA which equated to $70 million and increased by 58% sequentially. Interestingly enough its Adjusted EBITDA in Q4, was close to the combined EBITDA in the prior three quarters, which is a testament to the substantial improvement.

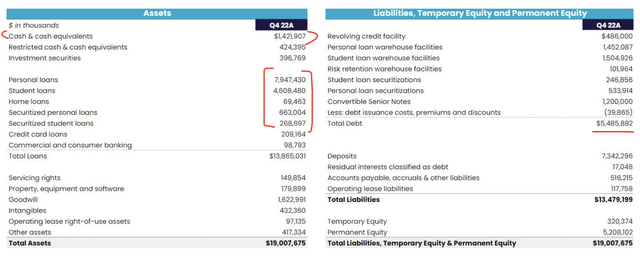

The company’s balance sheet includes $1.4 billion in cash and cash equivalents. In addition to $424 million in restricted cash and $397 million investment securities. Its total debt equates to $5.486 billion, although it should be noted that as the company is technically a bank its balance sheet includes loan balances and securitizations. Its “bank” business is currently operating at a 15% leverage ratio, which is the above the regulatory limits and thus healthy overall.

For Q1,2023, SoFi has guided for Adjusted net revenue growth of between $430 and $440 million, or a 34% to 37% growth rate. This is substantially slower than the prior quarters revenue growth of over 70% but still solid overall. I deem the slower growth expected to be driven by the forecasted recession, as well as the larger base which impacts calculation growth. For the full year of 2023, management is expected between 25% and 30% revenue growth year over year. In 2023, Interest rate driven income will likely be impacted, as we have seen inflation on a downward trend, thus interest rates could be lowered moving forward in the latter half of the year. Its Adjusted EBITDA is expected to $40 million to $45 million, which represents a 9% to 10% growth rate year over year.

Advanced Valuation

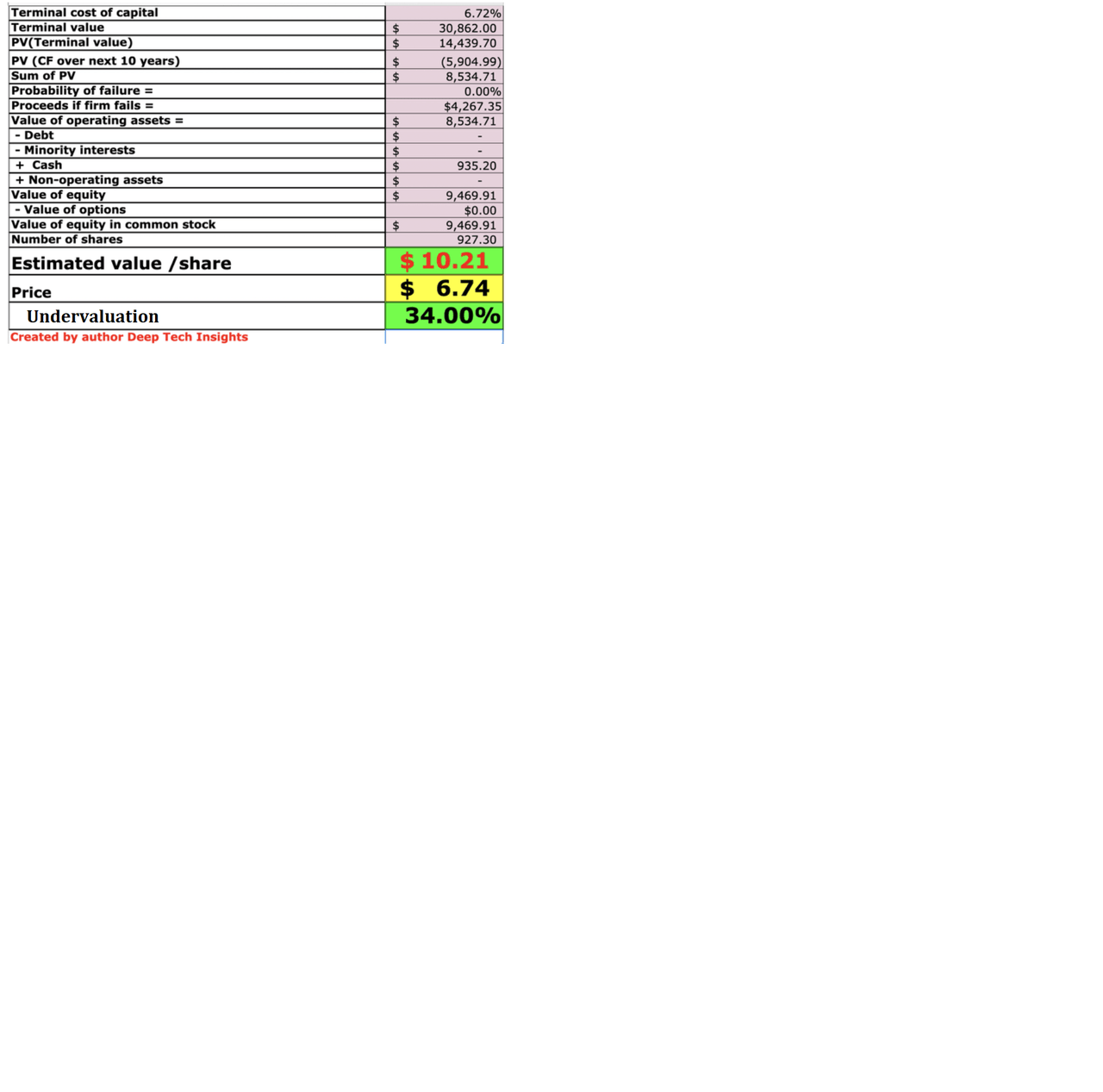

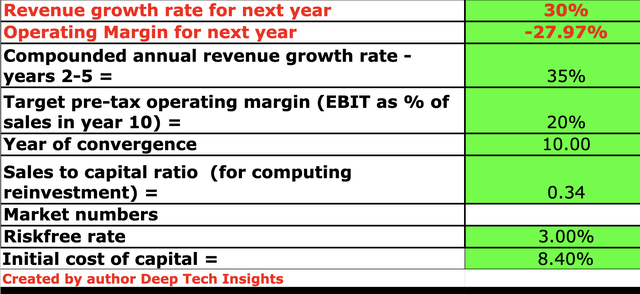

In order to value SoFi i have plugged its latest financials into my discounted cash flow valuation model. I have forecast 30% revenue growth for “next year”, which in line with the top end of managements forecast. Although I suspect some “sandbagging” may be going on, as we await the June 30th deadline for the Student loan payment write-off/delay outcome mentioned prior. 2023 is also expected to be a financially tepid year due to the forecasted recession, i will discuss in greater detail in the “Risks” section. In years 2 to 5, I have forecast 35% revenue growth per year, driven by an expected improvement in economic conditions as-well as a rebound in student loans.

SoFi stock valuation 1 (created by author Deep Tech Insights)

Moving onto margins, SoFi is still “unprofitable” on a GAAP basis, with a net loss of $40 million reported in Q4,22. A positive is its profitability has improved by $71 million year over year and $34 million sequentially. This is a positive sign and as the business scales I forecast margin improvement, due to the operating leverage of the business. In addition, the increasing number of products offer cross-selling opportunities and its brand power and network effects are likely to continue compounding, lowering customer acquisition costs. In the earnings call, management suggested that the business will become GAAP profitable by Q4,23 with Net income margins of 20%. To be conservative in my valuation, I have forecast a pre-tax operating margin of 20% over the next 10 years.

Given these conservative estimates I get a fair value of $10.21 per share, its stock is currently trading at ~$6.74 (after the share price pop) and thus the stock is 34% undervalued.

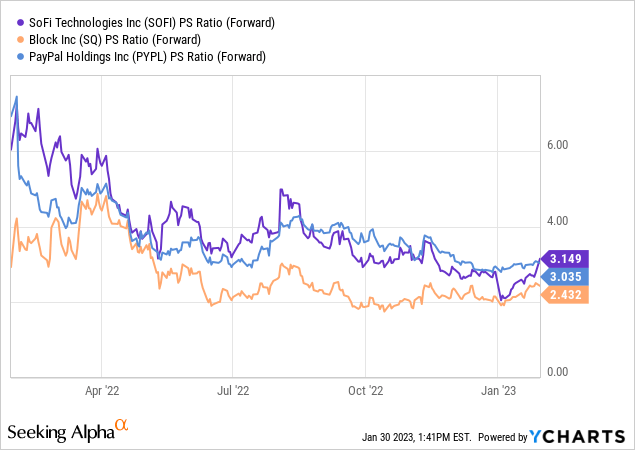

As an extra datapoint, SoFi is trading at price to sales ratio = 3.149, which is lower than its Q1,22 ratio of over 5. It does trade slightly more expensive than Block (SQ) and PayPal (PYPL), although they do operate different business models.

Risks

Recession/Student Loans

Many analysts have forecast a recession in 2023, driven by the high interest rate and inflationary environment. We have already seen this impact home mortgages by SoFi and I expect this to continue moving forward in 2023. We are also approaching the June 30th student loan court case deadline. If the Biden Administration wins this it could result in a large reduction in student loans across the U.S., which would impact SoFi negatively and effectively lower its total addressable market.

Final Thoughts

SoFi has continue to grow its business across both revenue and earnings since its IPO in June 2021. The company has proven its ability to execute a diversified business model as its student loan business is currently handcuffed. SoFi is also poised to benefit from an increasing number of cross sells for its products and growth in the buy now pay later space. Despite the increase in stock price since the start of 2023, its stock is undervalued intrinsically according to my valuation model, thus it could be a great long term investment.

Source link