Rich Fury

Introduction

Over the past week, major banks reported earnings, and the general understanding investors took away from the earnings were that the banks are preparing for an economic slowdown in 2023. As JPMorgan (JPM) calls it, the economy may see a “mild recession” as the macroeconomic conditions continue to deteriorate. Thus, the risks coming from consumer lenders have been highlighted. Major lenders have been seeing delinquency rates ticking up throughout 2022 and continue to expect the trend to continue, raising the risks for consumer lenders significantly.

Although the broad market may see potential risks in multiple forms of loans, I do not see similar risks for SoFi (NASDAQ:SOFI). The company not only has high-quality customers but SoFi, today, is uniquely positioned as a player reliant on personal loans. Contrary to popular belief, during this particular economic slowdown, personal loans may see the lowest delinquency rates increase as the dynamic of the personal loan market has changed. Further, SoFi’s other forms of loans, home and student, are well shielded from potential economic downturns relative to other loan products. Therefore, I continue to be bullish on SoFi, a company that has been reliant on personal loans in 2022.

SoFi and Personal Loan

SoFi is heavily reliant on the personal loan market. SoFi’s strong growth rate in 2022 was the result of the strong demand for personal loans. SoFi’s total loan originations from 2022Q1 to 2022Q3 were about $13.77 billion, and personal loans accounted for about $7.31 billion or about 53% of the total. Considering the fact that the lending business’s contribution profit of $560 million exceeds the company’s total contribution profit from lending, technology, and financial services by $111 million, I believe it is reasonable to argue that SoFi’s growth heavily relies on the personal loan market today. As a result, a relatively strong personal loan market in comparison to other lending products will likely equate to SoFi’s positive performance compared to negative expectations.

Personal Loan Market

Personal loans are an unsecured form of credit that is relatively easy to access compared to traditional secured loans such as HELOC. Consumers seeking a personal loan do not need to visit a bank. In fact, consumers can apply for a loan and be accepted in a matter of seconds using a smartphone from the comfort of their homes. Historically, for this reason, the personal loan was perceived as risky loans. However, in today’s world, this might not be the case.

In 2022, according to Experian, personal loan accounts increased by 16%, and the primary cause of the massive growth came from debt consolidation. This is different from the past. Before the pandemic, consumers got personal loans to spend the money, whether it was necessary or discretionary. For example, according to the report published in 2019 by Mortgage Reports, the top reasons consumers got a personal loan were medical bills, debt consolidation, home renovation, funding a start-up, wedding, vacation, and other unexpected expenses. As you can see, other than debt consolidation, the reason consumers got personal loans was to spend money, which, in my opinion, has likely led to a high delinquency rate. The combination of easy access to capital and willingness to trade goods and services for liability may have been the culprit behind the high delinquency rate. In comparison, today, the primary cause of getting a personal loan is to consolidate debt, an effort to save money. The nature of the demand for personal loans has changed from splurging on services and goods to protecting oneself from financial risk. I view this phenomenon not as a sign of weakness but as a sign of increased caution. Consumers are smarter, shielding themselves from high-interest credit card loans using a personal loan. Consumers taking precautions to protect themselves financially, in my opinion, can not be viewed as a negative sign. Therefore, I believe SoFi’s personal loan will be relatively safer than expected as the nature of the market has shifted.

Further, since the inception of online personal loans by the fintech companies starting in the early 2010s, the market has drastically changed for the better. According to the personal loans report by LendEDU, personal loan delinquencies declined to 3.02% in 2018 from 8.50% in 2012 (LendEDU used data from TransUnion (TRU)). The drastic change, according to the report, came from a high mix of prime borrowers with an average applicant FICO score of 741 and a low approval rating of 23.88%. I view this positive change as a result coming from fintech companies having access to more data points. According to Plaid, fintech lending is “the use of innovative technology in lending to increase the speed and equality of credit loans,” and because more users over time create drastically more data points for the fintech companies like SoFi to analyze, it is only natural that assessing risks become more accurate. Therefore, through increased data points for better artificial intelligence risk management, fintech companies’ personal loan risks will be greatly lower than in previous years.

(I used pre-pandemic data as fiscal stimulus and Federal Reserve quantitative easing could have affected the market data.)

In the case of SoFi, this is especially true. SoFi has 124 million technology platform accounts and 4.7 million SoFi members to collect consumer data for safer lending. I believe the power of SoFi’s massive platform will allow the company to drastically increase the accuracy of a risk assessment model.

Finally, Discover Financial’s (DFS) 2022Q4 earnings reported on January 18th, 2023, support my viewpoint. Credit card loan 30-Day delinquency rate increased by 87 basis points or about 52% year-over-year to 2.53% and private student loan delinquency rate increased by 53 basis points or about 32% year-over-year. However, the personal loan delinquency rate increased by 11 basis points or about 16% year-over-year significantly lower than other forms of loans. Even when comparing principal charge-off rates, credit card loans increased by about 58% and private student loans increased by about 66% while personal loans increased by about 23%. Personal loan delinquency and charge-off rate increase were significantly lower than other forms of unsecured loans. Therefore, SoFi, similar to Discover’s results, will likely see better than expected losses from delinquencies.

SoFi’s Other Lending products

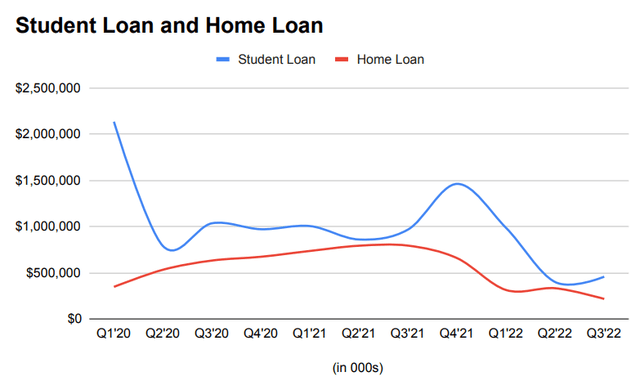

While SoFi has the largest exposure to personal loans, the company also has a sizeable balance of student and home loans, which accounted for 24% and 11% of the total loan originations from 2022Q1 to 2022Q2. Similar to personal loans, I believe SoFi’s student and home loans will also see relatively lower delinquency rates than the market expectations.

SoFi’s home and student loans are unique. It primarily targets customers wishing to refinance their loans, which is why I believe SoFi’s delinquency rates on these loans will be lower than the market average. According to the Federal Reserve Bank of New York, “refinancing into a lower-rate mortgage reduce[s] borrowers’ default rates on mortgages and nonmortgage debts by about 40 percent and 25 percent, respectively.” The primary reason behind this phenomenon was that consumers saved significantly more money by refinancing, and this is exactly what happened with SoFi’s student and personal loans.

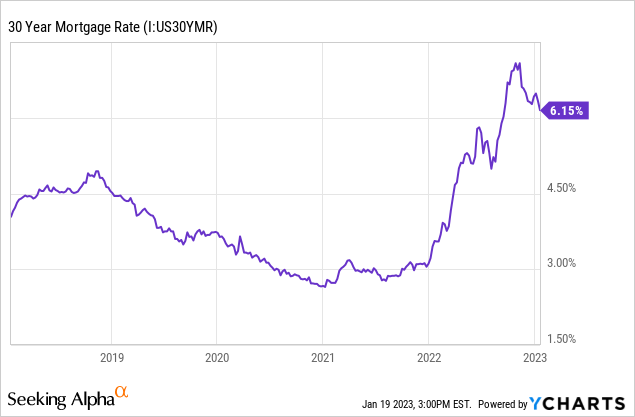

As you can see in the chart below, interest rates were at their lowest in 2020 and 2021, and as the picture below the chart shows, demand for SoFi’s student and home loan refinance peaked during times of low-interest rate environment. Therefore, the risks associated with SoFi’s home and student loans will likely be significantly lower than the market average.

Created by the author using SoFi Q3′ 22 Earnings

Summary

Today, SoFi is heavily reliant on the personal loan market, and with an upcoming potential recession, investors are expecting a sharp rise in the company’s total delinquency rates. However, I believe that because SoFi is exposed to relatively safe forms of loans including home, student, and personal loans, the fears that have been priced into SoFi’s stock price may be excessive. While personal loans were risky in the past, today, fintech companies like SoFi have had more data points over the years of operation to more accurately gauge the risk profile of each applicant. Furthermore, consumers are primarily seeking personal loans not to spend on discretionary goods or services but they are utilizing personal loans to consolidate debt, a cautious financial decision. Therefore, I believe SoFi’s loan delinquency rates will likely be lower than investor estimates throughout 2023.

Source link