Phototreat

Suncor Energy (NYSE:SU) may not be the most exciting stock, but this is a company which has embraced its status as a value stock. The company has benefited greatly from strong commodity prices, bringing down leverage rapidly while also rewarding shareholders with growing dividends and share repurchases. The company has already hit prior 2025 leverage targets, giving management the confidence to ramp up its share repurchase program. While commodity prices have shown some weakness amidst the tough macro backdrop, SU has emerged in a far stronger position and should only get stronger moving forward.

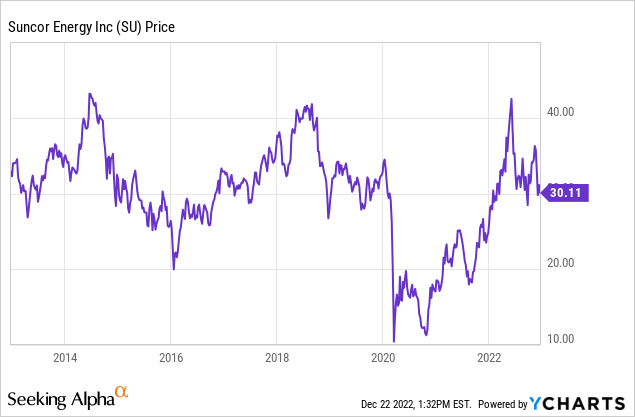

SU Stock Price

SU has dipped from recent highs amidst the worsening macro conditions though the stock is still up strongly from pandemic lows. Viewed over a longer time horizon, the stock has been a disappointing performer as it never was able to overcome its status as a cyclical stock.

I last covered SU in December 2021 where I rated the stock a buy on account of the roaring fundamentals. The stock has returned 30% versus a 20% decline for the S&P 500, stunning outperformance but the stock still remains very cheap here. While it may take some time, patience may reward long-term investors as Wall Street should eventually warm up to what is becoming a less risky story year after year.

SU Stock Key Metrics

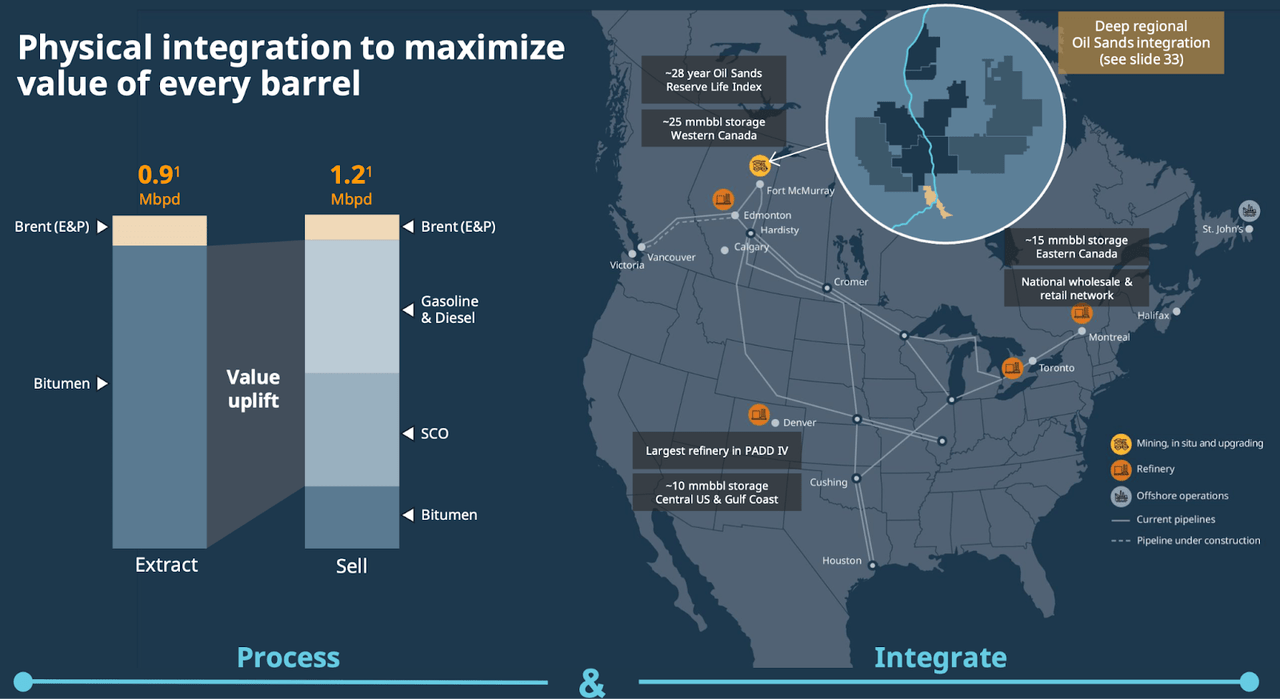

SU is an integrated energy company based in Canada – by integrated I mean that it owns the entire value chain from oil production, to refining, and finally to retail sales. That makes SU similar to Chevron (CVX) or Exxon Mobil (XOM) of the United States in that it represents one of the lower risk positions in the energy sector.

2022 Investor Day Presentation

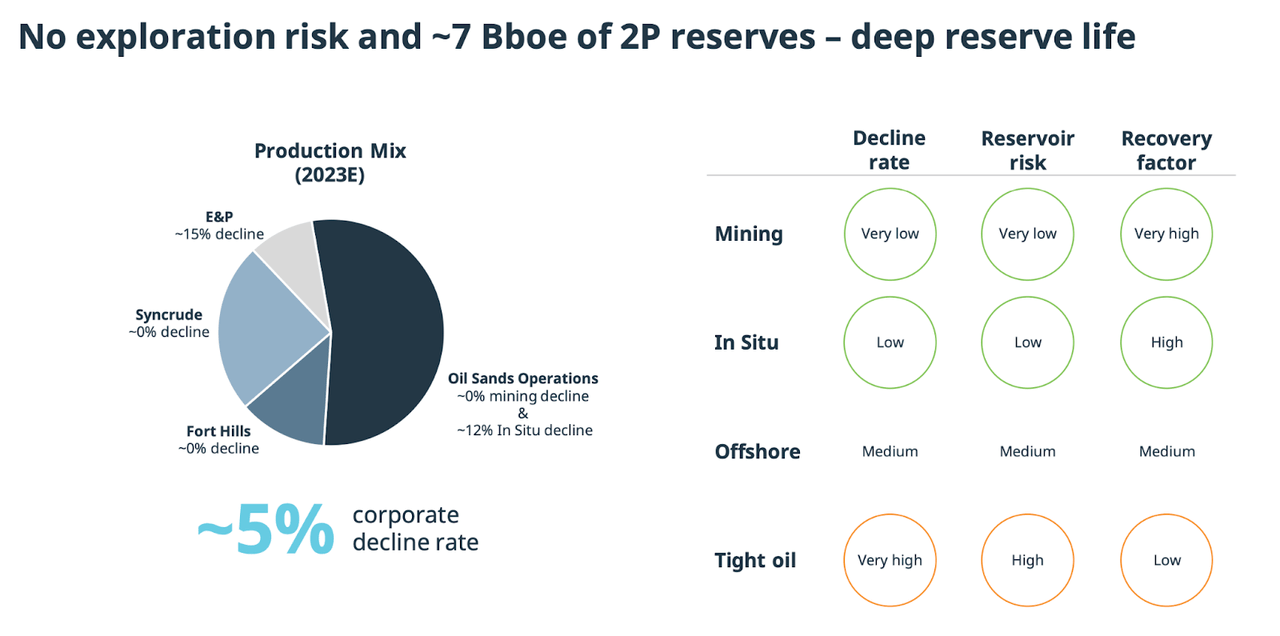

Unlike typical E&P companies, SU has access to the oil sands in Canada. These oil assets have very long term reserve life, enabling SU to generate stronger free cash flows than other oil companies due to not having to invest in exploration.

2022 Investor Day Presentation

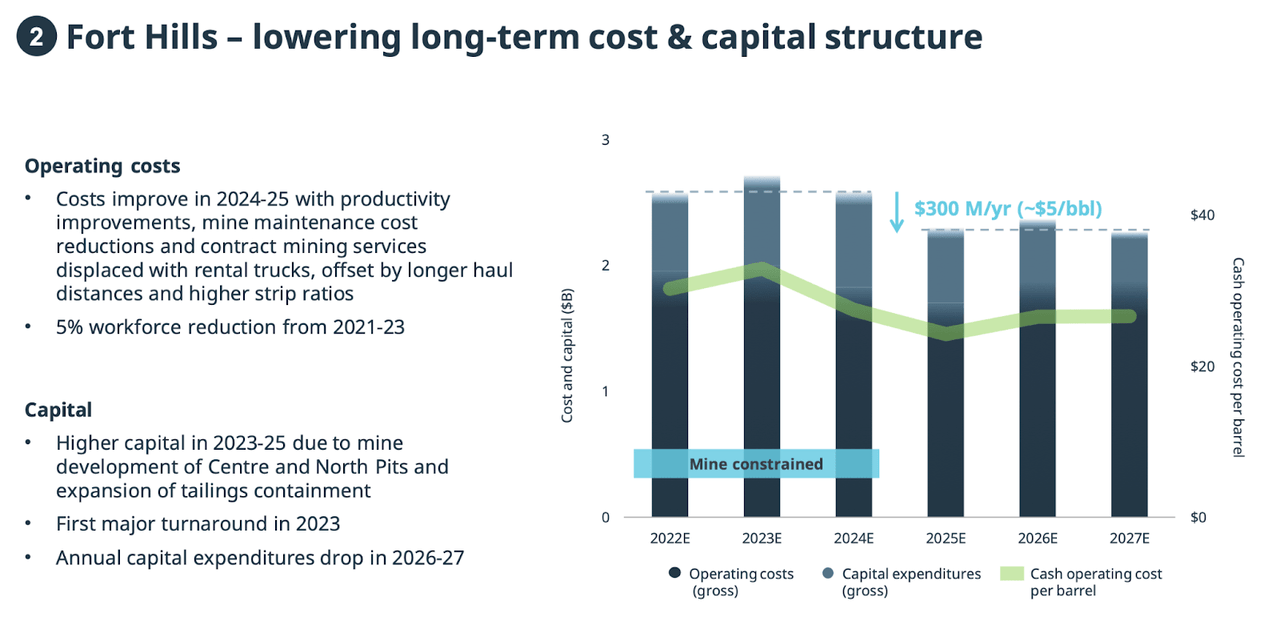

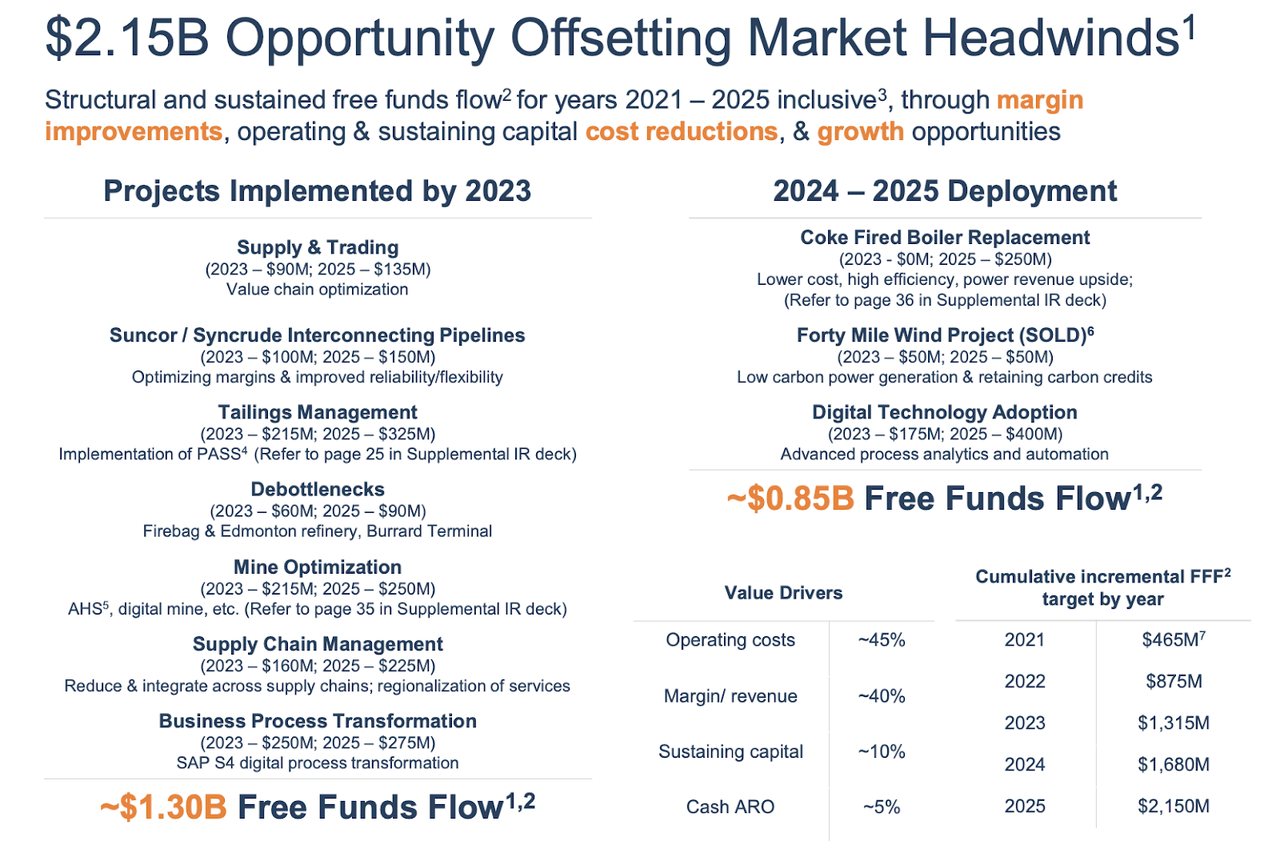

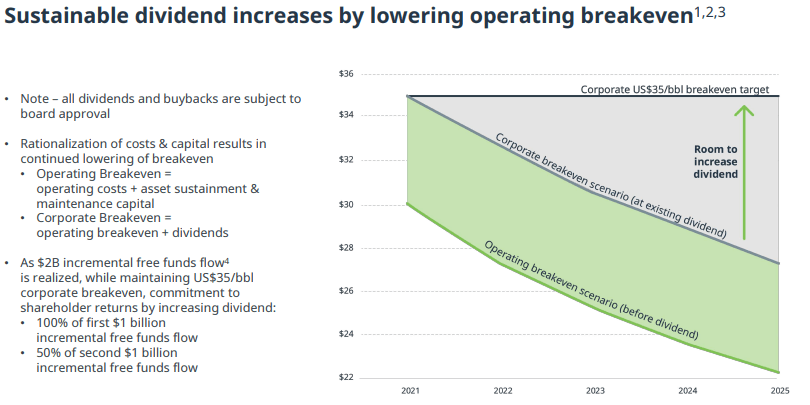

Going further on that, the attractive structural characteristics of the oil sands assets gives SU many opportunities for reinvestment. SU has consistently invested in reducing cash operating costs at its locations, helping to bring down its breakeven prices and hence reduce its risk in the event of another plunge in oil prices.

2022 Investor Day Presentation

The ongoing cost reduction plans are expected to help increase free funds flow by $2.15 billion by 2025. For reference, this is a $42 billion company so such a boost in cash flows is quite meaningful.

2022 Investor Day Presentation

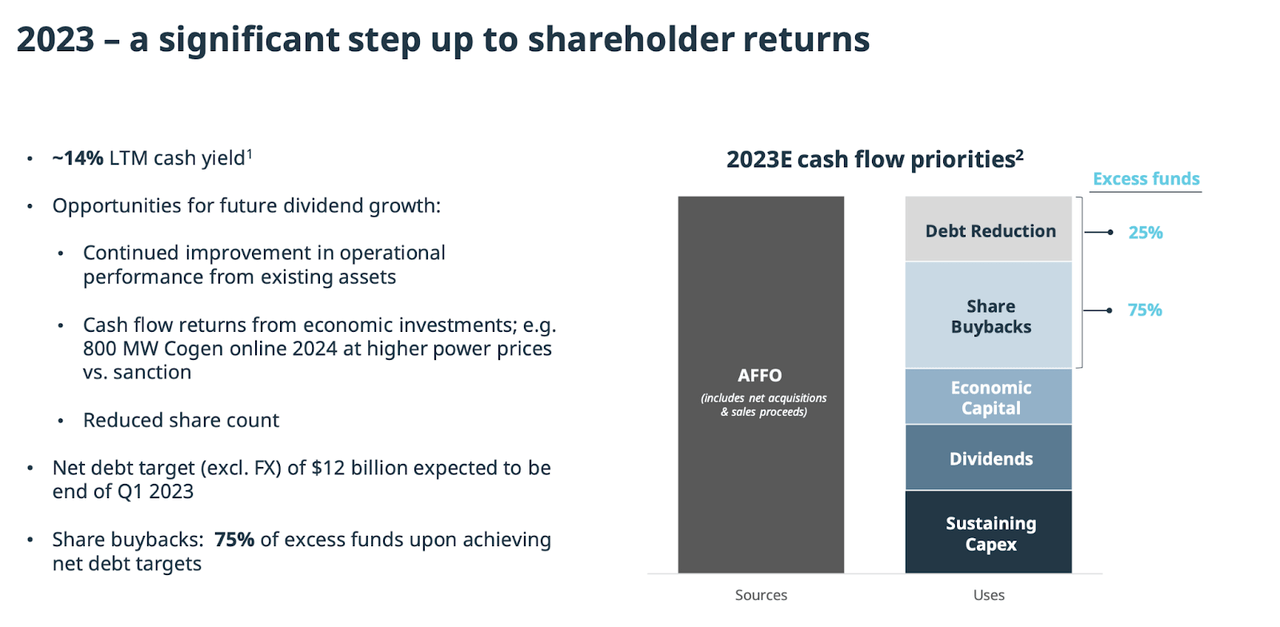

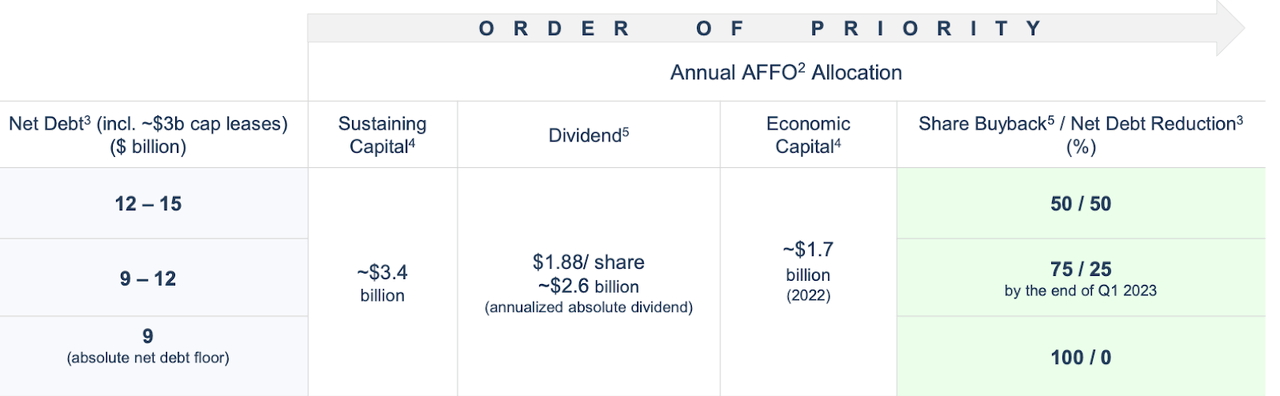

SU expects to achieve $12 billion in net debt by the end of the first quarter of next year. SU had previously guided to reach $12 billion to $15 billion of net debt by 2025. As stated on the conference call, management has found it prudent to increase the aggressiveness of its share buyback program because it is achieving its debt target far earlier than expected. Previously the guidance was for excess funds to be split evenly between debt paydown and share repurchases – management has now guided for 75% of excess funds to be put towards share repurchases, with the remaining 25% still slated for debt paydown.

2022 Investor Day Presentation

Once net debt hits $9 billion, which is their target absolute net debt floor, management has guided for 100% of excess funds to go towards its share buyback.

2022 Investor Day Presentation

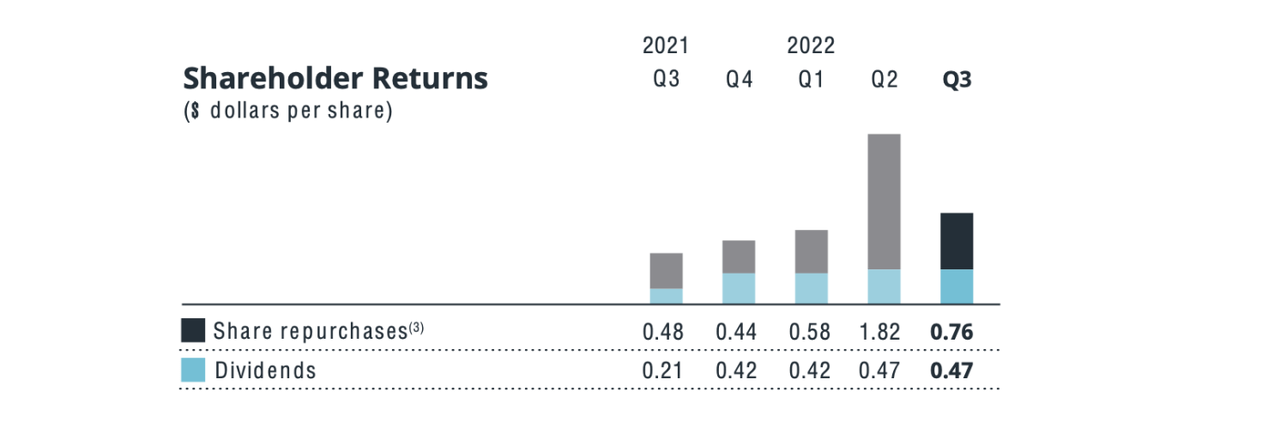

For reference, just this year SU has repurchased $4.6 billion in stock or 7.3% of shares outstanding. That is in addition to paying a hefty dividend.

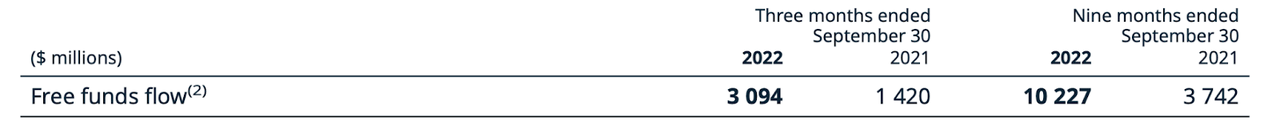

2022 Q3 Supplemental

How has SU been able to pay dividends, buy back stock, pay down debt, all while reinvesting in its core businesses? As mentioned earlier, the low exploration needs courtesy of the oil sands assets enables SU to generate robust free cash flows. SU generated $3.1 billion in free funds flow in the latest quarter alone.

2022 Q3 Supplemental

SU ended the quarter with $14.6 billion in net debt and 0.8x in net debt to AFFO. It is not hard to believe that the company can pay down $2.6 billion in net debt over the next two quarters given the high amount of cash generation.

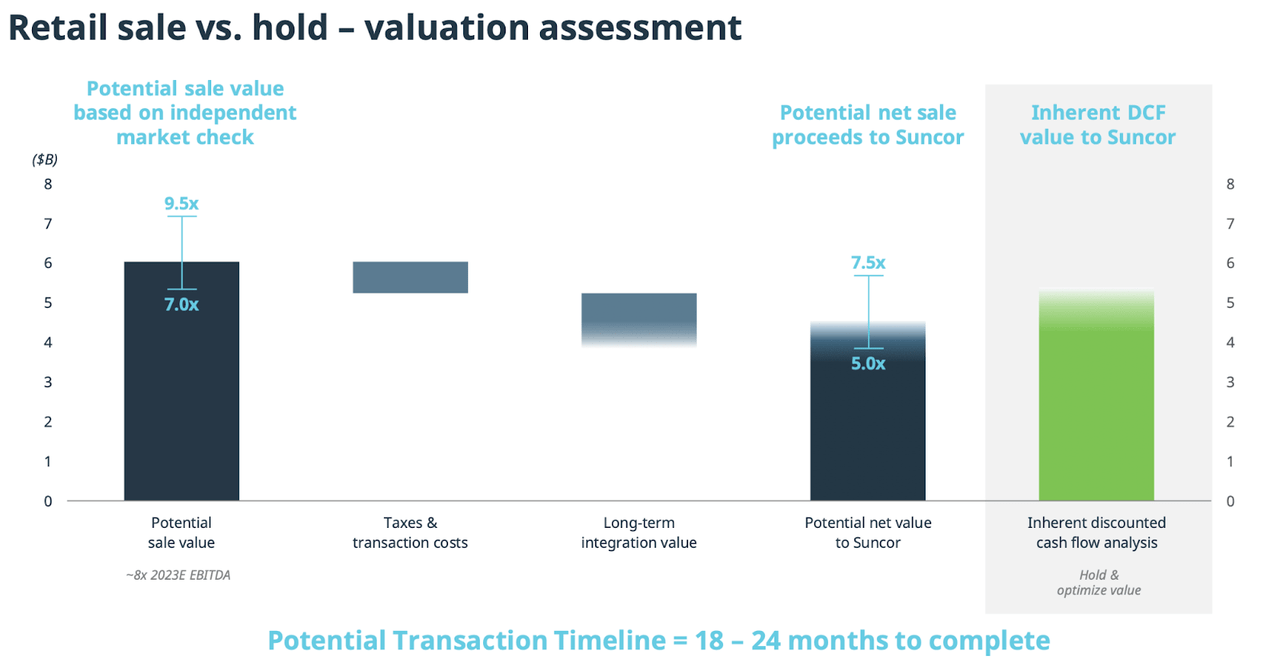

SU had previously been looking to sell off its retail segment, but after a review has come to the conclusion that it is better to hold on to those assets.

2022 Investor Day Presentation

Management cited that while there was interest in purchasing the assets, they were not comfortable with the proposed prices and many were not based on all-cash deal proposals.

Is SU Stock A Buy, Sell, or Hold?

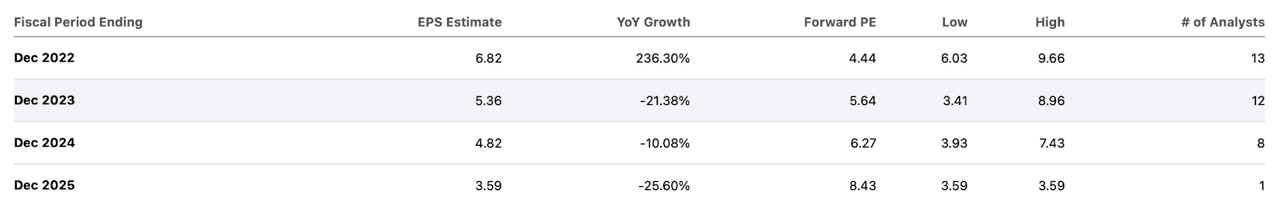

SU trades at just under 5x earnings – an astonishingly cheap multiple. That said, valuations look cheap across the energy sector due to the high commodity prices. Earnings are expected to come down meaningfully, likely signaling the market’s expectation that oil prices will come down as rising interest rates leads to demand destruction.

Seeking Alpha

Even so, SU is trading at just 8.7x 2025e earnings. Energy stocks typically trade on cyclical assumptions, meaning that multiples tend to be more conservative. Yet Wall Street may be underestimating the rapidly reducing risk profile at SU. At its 2021 Investor Day, SU had guided for its dividend to be covered even assuming that oil prices fell to as low as $35 per barrel (SU has since already completed the projected growth in its dividend).

2021 Investor Day

With net debt already at conservative levels, I see the risk profile of SU being moderate even in the event of a steep crash in oil prices, as it is financially supported to weather any storm. The stock is yielding around 5% at current prices. Sure, the stock might trade lower to around a 7% yield if oil prices crash, but at the same time I could also see the stock still trading at the current 5% yield as investors anticipate a subsequent recovery in commodity prices. Meanwhile, XOM and CVX each are currently trading at around 8x to 9x earnings. SU has 100% upside to trade in-line with those peers and such an expectation is not so unreasonable considering the low leverage and low breakeven prices at the company.

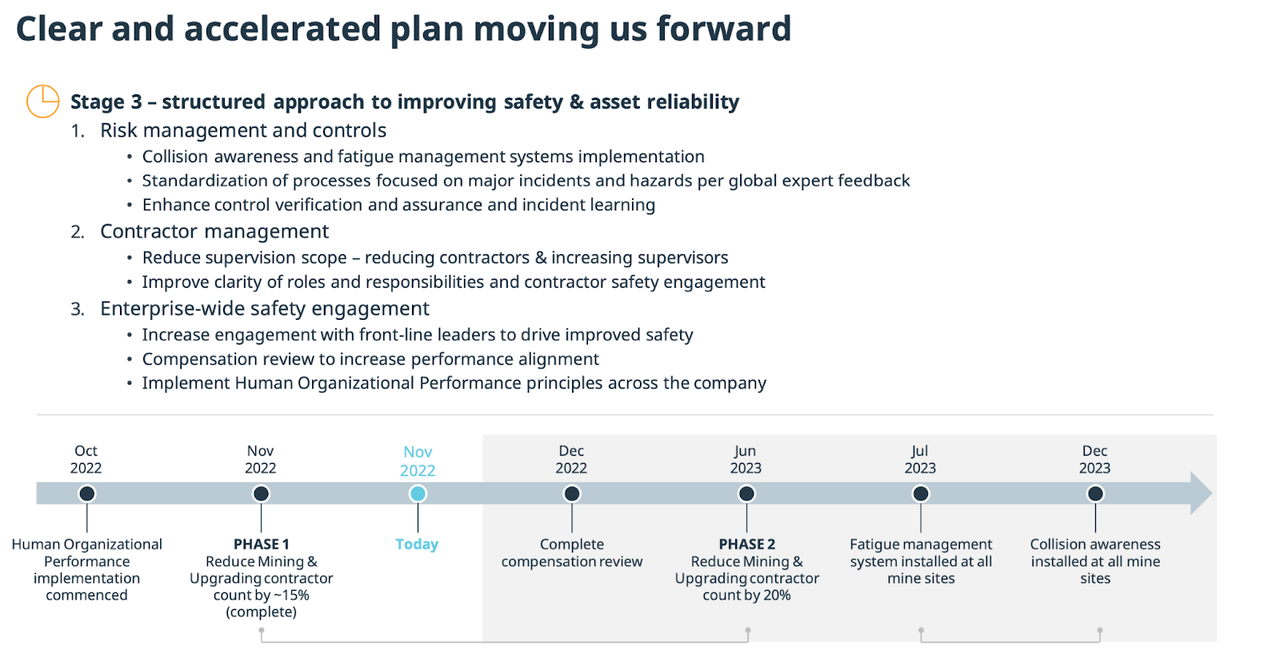

What might be holding the company back? SU has suffered from safety issues in recent years, so much so that it has had to implement a long-term plan to improve safety reliability.

2022 Investor Day Presentation

It is unclear if SU will have to suffer any financial impact from past or future safety issues. The oil sands has been called the “world’s most destructive oil operation” and for that reason, investors may be discounting the risk that the Canadian government begins to implement greater scrutiny on the industry. I find such an outcome unlikely considering how crucial the energy sector is for the Canadian economy, but the possibility (and fear) of such an outcome can be an overhang on the stock price. Sure, share repurchases can help take advantage of that fear, but investors looking for a quick bounce in the stock may be disappointed. That factor may be one reason why SU did not perform nearly as well as many US counterparts amidst the surge in oil prices in recent years. It is possible that SU is unable to execute on its projected cost savings and/or inflation leads to breakeven prices rising higher than expected – such events always seem to coincide with big events like a crash in oil prices. It may be difficult to hold SU stock amidst a plunge in commodity prices due to that uncertainty, as plunging stock prices might be pricing in such negative prospects. For now, I find SU to be highly buyable as the company has executed strongly on paying down net debt and is set to increase the aggressiveness of its share repurchase program.

Source link